UOB Kay Hian Malaysia

Home

About UOB Kay Hian Securities

UOB Kay Hian Securities operates as a significant financial institution in Southeast Asia, operating under the umbrella of United Overseas Bank. The company maintains a strong presence across multiple regional markets, with headquarters in Singapore and substantial operations in Malaysia, Thailand, and Hong Kong. Our organization brings together over 50 years of financial market expertise, providing comprehensive investment solutions to both retail and institutional clients. With more than 80 branches worldwide, UOB Kay Hian Securities demonstrates consistent growth and reliability in the financial sector.

Key Company Information:

| Category | Details |

| Founded | 1970 |

| Headquarters | Singapore |

| Regulatory Bodies | MAS, FINRA |

| Number of Branches | 80+ worldwide |

| Trading Markets | Multiple Asian exchanges |

| Customer Base | Retail and institutional investors |

Trading Platforms and Technology

UOB Kay Hian Securities provides advanced trading solutions through multiple platforms designed for different trading needs. The UTRADE Plus platform serves as our flagship trading system, offering real-time market data and advanced charting capabilities. Settrade Streaming delivers professional-grade trading tools with instant market access. Mobile applications enable trading on various devices, ensuring constant market connectivity. These platforms incorporate modern security measures to protect user data and financial transactions.

Investment Products

The company offers diverse investment opportunities across multiple asset classes. Securities trading encompasses stocks listed on major Asian exchanges, with access to international markets. Fixed-income products include government and corporate bonds with various maturities. Derivative instruments provide additional trading opportunities through futures and options contracts. Exchange-traded funds offer diversified investment exposure across different sectors and regions.

Main investment categories available:

- Equities and ETFs

- Bonds and fixed-income securities

- Derivatives and structured products

- Mutual funds and unit trusts

- DRx (Fractional Depository Receipts)

- Currency trading solutions

Account Types and Features

UOB Kay Hian Securities maintains several account categories to accommodate different investment approaches. Each account type provides specific advantages and trading capabilities based on investor requirements. Account holders receive access to research materials, market analysis, and trading tools. Security measures include segregated client funds and multi-factor authentication for all accounts.

Cash Account Features

The Cash Account represents our standard trading solution. This account requires full payment for securities purchases, maintaining traditional investment approaches. Trading occurs with available funds, preventing leverage-related risks. Account holders receive complete access to trading platforms and research materials.

Margin Account Benefits

Margin accounts enable trading with borrowed funds, expanding investment possibilities. These accounts maintain specific collateral requirements to ensure trading security. Interest rates remain competitive within the regional market. Regular monitoring helps maintain appropriate margin levels and market exposure.

Research and Analysis Services

Research services include comprehensive market analysis and investment recommendations. Professional analysts provide regular updates on market conditions and trading opportunities. Technical analysis tools assist in identifying market trends and entry points. Fundamental research covers economic indicators and company-specific information.

Current research offerings:

- Daily market updates

- Company-specific analysis

- Economic trend reports

- Technical trading signals

- Industry sector reviews

- Investment strategy recommendations

Trading Costs and Fees

| Service Type | Fee Structure |

| Equity Trading | From 0.18% |

| Options Trading | From 0.5% |

| Platform Usage | No charge |

| Account Maintenance | Varies by type |

| Research Access | Included |

Security and Regulation

Regulatory compliance remains central to operations, with oversight from major financial authorities. Security systems protect client data and trading activities through multiple layers. Regular audits ensure compliance with international financial standards. Risk management procedures safeguard client assets and trading operations.

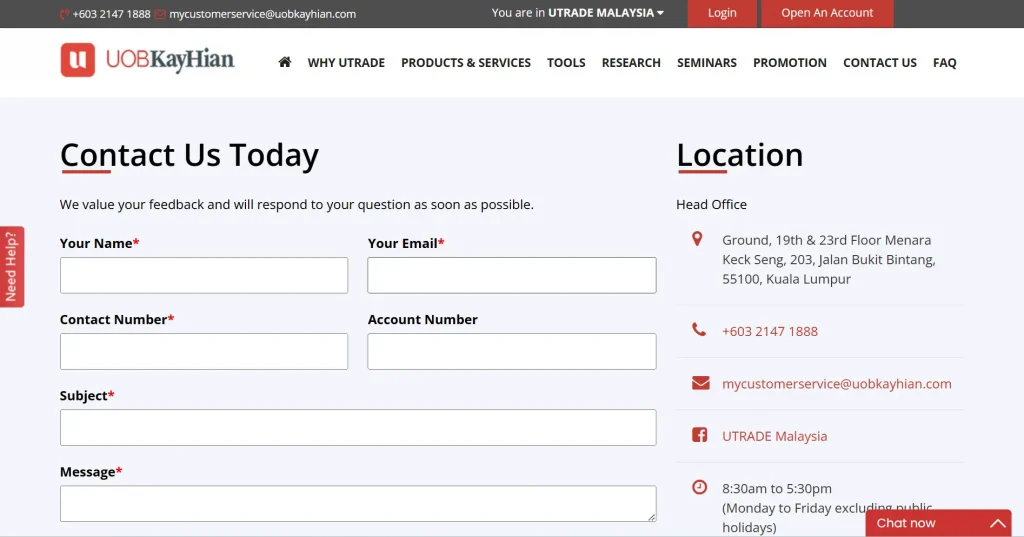

Customer Support Services

Support services operate during market hours to assist with trading and technical issues. Multiple communication channels ensure accessible support options. Response times maintain efficiency standards for client assistance. Training resources help clients maximize platform usage and trading capabilities.

Available support channels:

- Telephone assistance

- Email support

- Branch office consultations

- Online chat services

- Social media channels

- Technical help desk

International Market Access

Market access extends across major Asian financial centers. Trading hours align with regional exchange operations. Settlement processes follow international standards for each market. Currency conversion services facilitate cross-border trading.

Regional Exchange Connectivity

| Exchange | Trading Hours |

| Malaysia | 9:00-17:00 |

| Singapore | 9:00-17:00 |

| Hong Kong | 9:30-16:00 |

| Thailand | 10:00-16:30 |

Educational Resources

Educational materials cover various trading and investment topics. Regular seminars provide practical trading knowledge and market insights. Online resources include trading guides and market analysis tools. Professional instructors conduct training sessions for different skill levels.

Frequently Asked Questions

The minimum deposit varies by market, starting from THB 5,000 for Thai markets and THB 50,000 for international markets. Different account types may have specific requirements based on trading objectives.

Client funds remain segregated from company operational accounts. Regulatory oversight ensures compliance with financial security standards. Insurance coverage provides additional protection for eligible accounts.

Mobile trading applications include UTRADE TH and Settrade mobile platforms. These applications provide full trading functionality and market data access. Regular updates ensure security and performance improvements.