UOB Kay Hian Brokerage Fee

Home » Brokerage fees

Fee Structure Overview

UOB Kay Hian Securities Malaysia presents transparent fee schedules for trading activities. The commission structure varies according to specific market requirements. Our platform fees maintain consistency across different account categories. Additional charges apply for specialized international trading operations. Market-specific fees reflect current trading environment conditions. Service charges accommodate both retail and institutional requirements.

Standard Trading Fee Structure:

| Service Type | Basic Rate | Min. Commission | Annual Fee |

| Local Equities | 0.42% | MYR 12 | None |

| Foreign Shares | 0.50% | USD 20 | USD 50 |

| Derivatives | 0.30% | MYR 28 | MYR 100 |

| Online Trading | 0.21% | MYR 8 | None |

| Phone Trading | 0.50% | MYR 25 | None |

Commission Rate Categories

Malaysian market operations follow standardized commission rate structures. Volume-based discounts reward frequent trading activities effectively. Commission calculations reflect current market value standards. Institutional traders receive specialized pricing consideration packages. The fee structure accommodates various trading frequencies. Regular reviews ensure competitive rate maintenance.

Local Market Trading Fees

Bursa Malaysia transactions follow established fee guidelines. Higher trading volumes qualify for preferential rates. Local market operations maintain competitive fee structures. Standard charges apply across equity market segments. Trading frequency determines applicable discount levels.

International Market Costs

Foreign market access requires additional processing charges. Currency conversion fees apply to international transactions. Each foreign market maintains specific fee schedules. International clearing processes include standard charges. Market-specific regulations influence total trading costs.

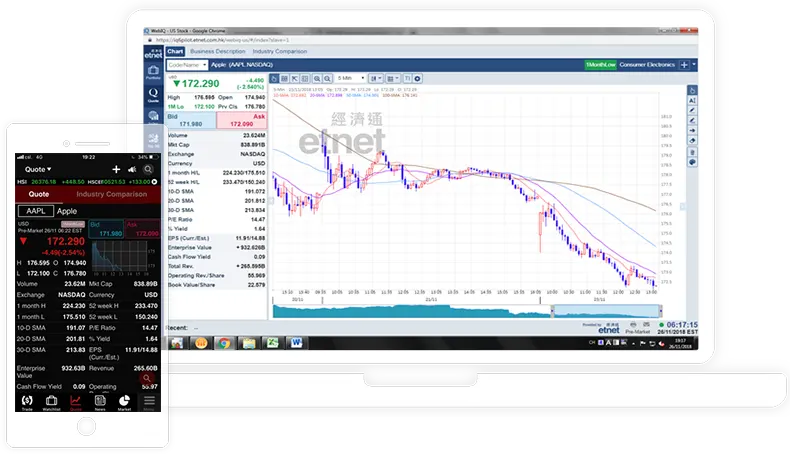

Electronic Trading Platform Fees

Standard electronic trading platforms maintain fixed costs. Premium features require additional subscription payments regularly. Mobile trading applications follow basic commission structures. Platform maintenance fees apply to professional services. Real-time data services include separate charge structures.

Essential trading service charges:

- Basic platform access fees

- Real-time market data subscriptions

- Premium trading tool costs

- Research portal access charges

- Professional chart service fees

Account Management Charges

Account maintenance requires standard monthly service fees. Inactive accounts incur additional holding charges. Minimum balance requirements affect service pricing structures. Account type determines applicable fee categories. Service level selections influence overall costs.

Settlement Processing Fees

| Process Type | Standard Fee | Processing Time |

| Local Settlement | MYR 10 | T+2 |

| International | USD 25 | T+3 |

| Express Processing | MYR 50 | Same Day |

Margin Trading Costs

Margin account operations include interest charges. Collateral requirements affect trading cost calculations. Different securities maintain varying margin rates. Market conditions influence margin requirement levels. Regular margin calls require prompt settlement.

Interest Rate Structure

Daily interest calculations apply to margin positions. Market conditions determine current interest rates. Different currencies maintain separate interest schedules. Margin excess receives preferential interest considerations. Regular rate reviews reflect market changes.

Collateral Management Fees

Securities pledged as collateral require processing. Different securities types affect collateral values. Regular valuation updates determine margin requirements. Collateral transfer operations include processing fees. Market volatility influences collateral calculations.

Research Service Charges

Professional research services include subscription fees. Market analysis reports require separate payments. Trading recommendations include service charges. Technical analysis tools require premium subscriptions. Research platform access includes monthly fees.

Available research services:

- Daily market analysis reports

- Technical trading recommendations

- Fundamental research documents

- Economic trend analysis

- Corporate action updates

Custody and Corporate Action

Securities custody services include annual charges. Corporate action processing requires additional fees. Foreign securities demand higher custody rates. Share transfer operations include processing costs. Certificate issuance requires standard processing fees.

Government and Regulatory Charges

| Fee Type | Rate | Application |

| Stamp Duty | 0.1% | All Trades |

| Clearing Fee | 0.03% | Per Transaction |

| GST | 6% | Service Charges |

Foreign Exchange Service Fees

Currency conversion includes standard processing charges. Different currency pairs maintain varying spreads. Foreign exchange transactions require clearing fees. Market rates determine conversion costs. Regular reviews update exchange rates.

Frequently Asked Questions

Trading volume and market type affect commission calculations. Account category influences applicable rate structures. Regular trading activity may qualify for discounts.

Current market rates determine conversion prices. Standard spreads apply to currency pairs. Processing fees include clearing house charges.

Trade execution triggers commission calculations immediately. Settlement processes include all applicable fees. Account statements reflect charged commissions clearly.